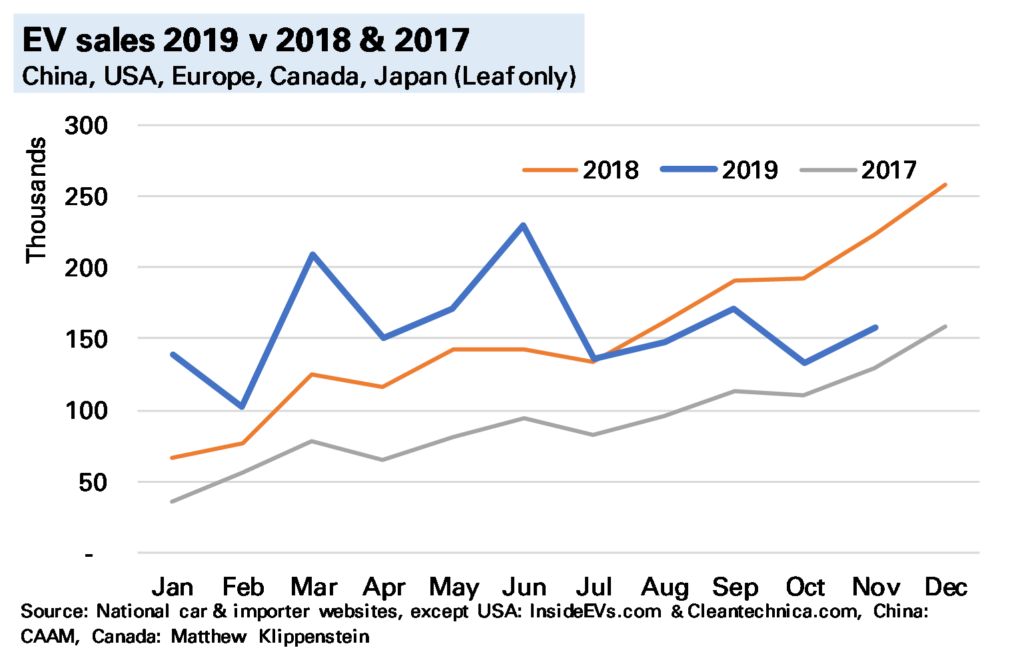

In November global electric vehicle (EV) 1 sales I estimate were about 160k, 29% lower YoY, continuing the slump seen in recent months.

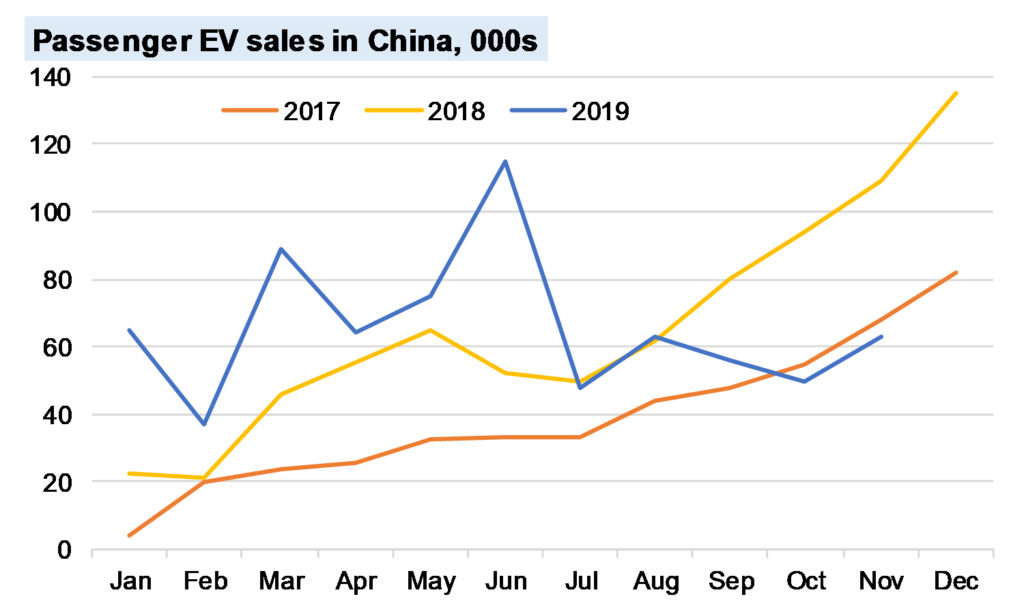

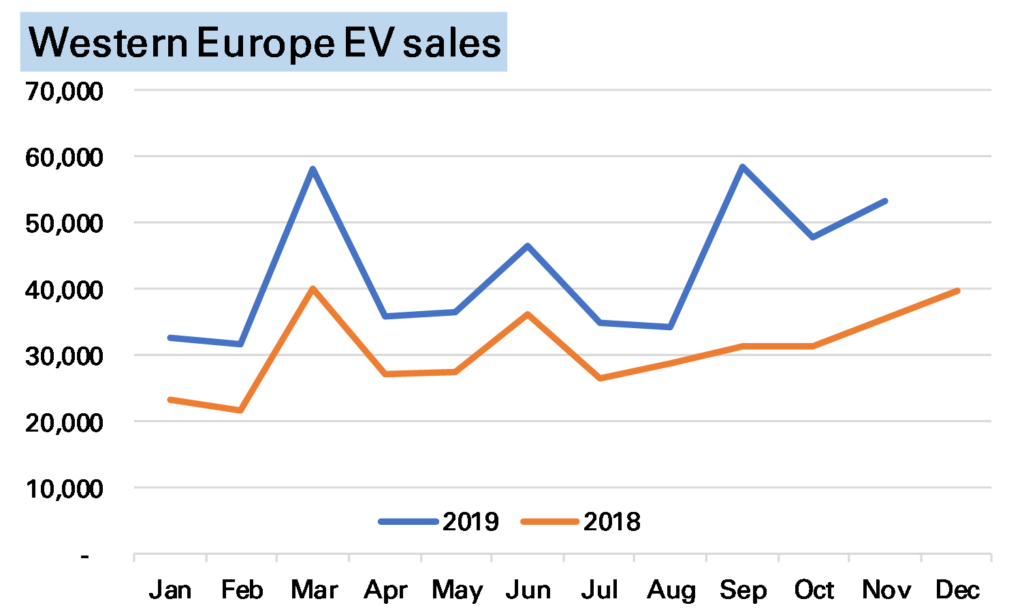

China accounts for most of the slowdown, being by far the largest market and down 45% YoY, little better than in October. Europe, on the other hand, while still a considerably smaller market, posted another solid growth rate of 49% YoY. The difference between the two markets is largely incentives – much lower in China since mid-year but remaining strong in Europe. The USA looks to be running somewhat lower than last year, though we await better data at year-end.

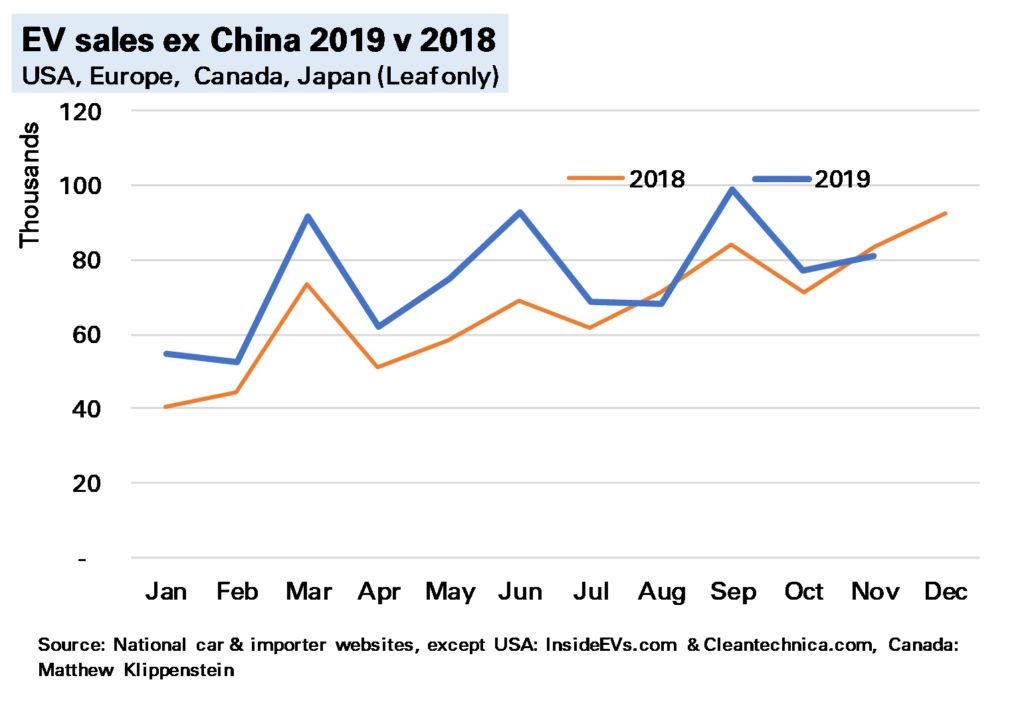

Overall, as the final chart shows, even excluding China, EV sales in November were no higher than in the same month of 2018.

(Note click on charts to show at full size)

With just one month to go it’s clear 2019 has been a disappointing year. Year-end is hard to predict but on current trends global EV sales are likely to be just under 2m, only 6% higher than in 2018. Chinese EV sales are likely to be flat or slightly down, as are US EV sales, while Europe will be up 40-50%. This will mean while China’s share of global EV 2 sales falls from 56% to just over 50%, Europe’s will have risen to 27% from 20%.