Today marks the last day of the European central bank gold agreement (CBGA).

Announced on September 27 1999, and renewed at five-year intervals up to 2014, this was often described as a pact to limit central bank gold sales and lending, though arguably its main role was to improve market conditions sufficiently to give space for hefty European sales. From around the mid-2000s European central banks lost interest in selling gold, and as such the pact became rather pointless, the main reason why in 2019 it wasn’t renewed.

Central bank’s attitudes to gold have changed significantly since 1999. Back then global central bank gold holdings still largely reflected the relative economic strengths of countries at the end of Bretton Woods era (1970s). 85% of the world’s 30,300 tonnes of official gold (excluding that held by the IMF & BIS) was owned by the “Advanced Economies”, and almost all of that, 80% of the world, by the USA and Western European countries.

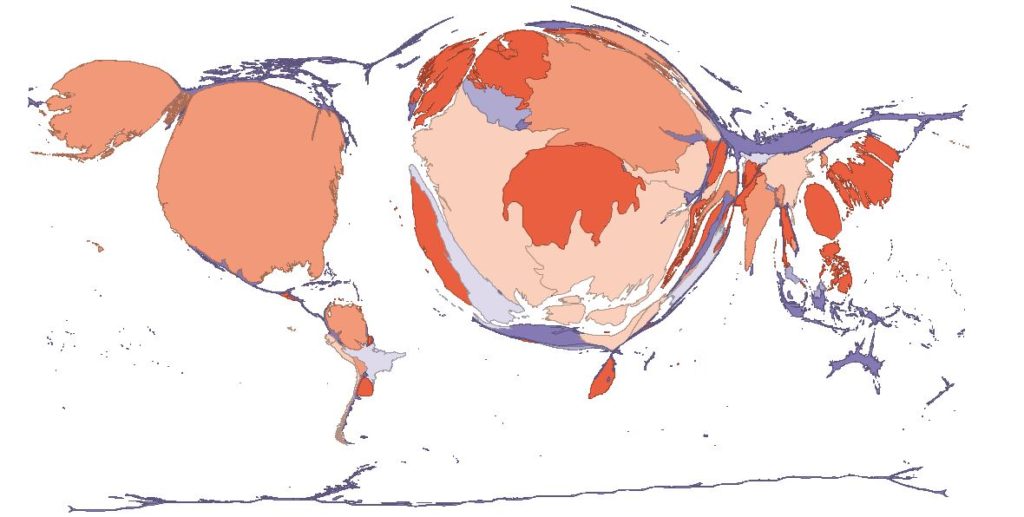

This geographical skew can be seen clearly in the following map, where I’ve resized the countries of the world by their official gold holdings – shows this clearly (ignore the colours)

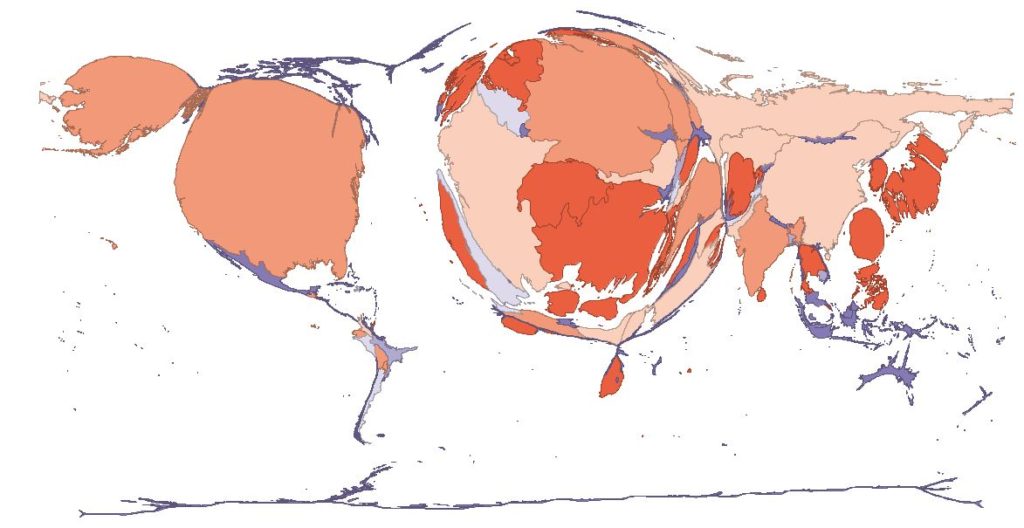

Fast forward 20 years and a map redrawn to reflect August 2019 gold holdings and at first glance nothing much has changed – the USA and Western Europe still dominate, even if the latter is somewhat smaller.

But look a little more closely and now Russia and Asia are far more visible.

This is because there has been a slow shift since the first CBGA was signed in 1999. The “Advanced economies” have sold nearly 4,000t, mainly through the CBGA – with gold holdings in the Eurozone down nearly 1,800t, in Switzerland 1,580t, and in the UK over 300t. Their share is now 70%, down from 85% in 1999. But globally gold held by central banks is up around 1,000t – because “Emerging and developing” economies have added nearly 5,000t. Russia and other CIS countries have been at the forefront of this, but China has also increased its reserves dramatically, and so have a reasonably wide range of other countries, including India, Mexico, and Thailand.

This shift is likely to continue. Certainly central banks are still buying, as noted in Tuesday’s post, with 1H 2019 seeing a record amount. This trend has many drivers but a slow – very slow – loss of faith in the US dollar seems behind some of it, not just in Russia. We’ve not seen any evidence of European selling resuming, indeed the main activity there purchases this year and last by Hungary and Poland. However I would think in another 20 years Western European gold holdings will be lower than they are today.