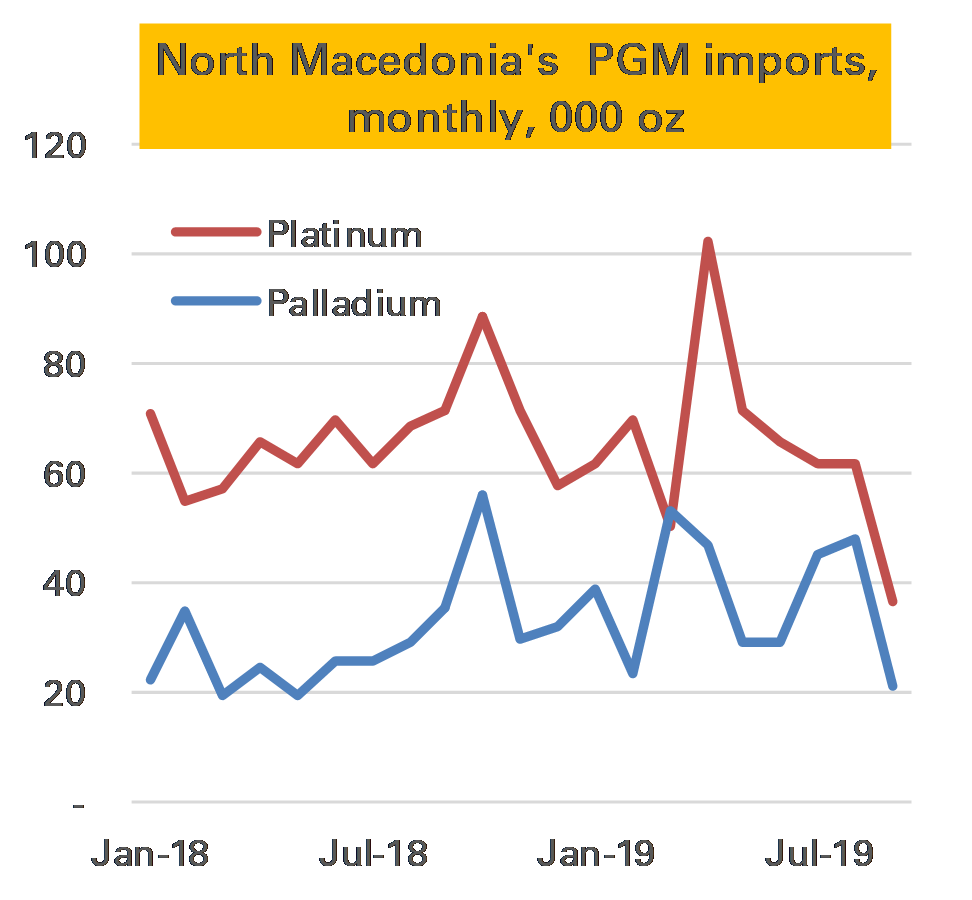

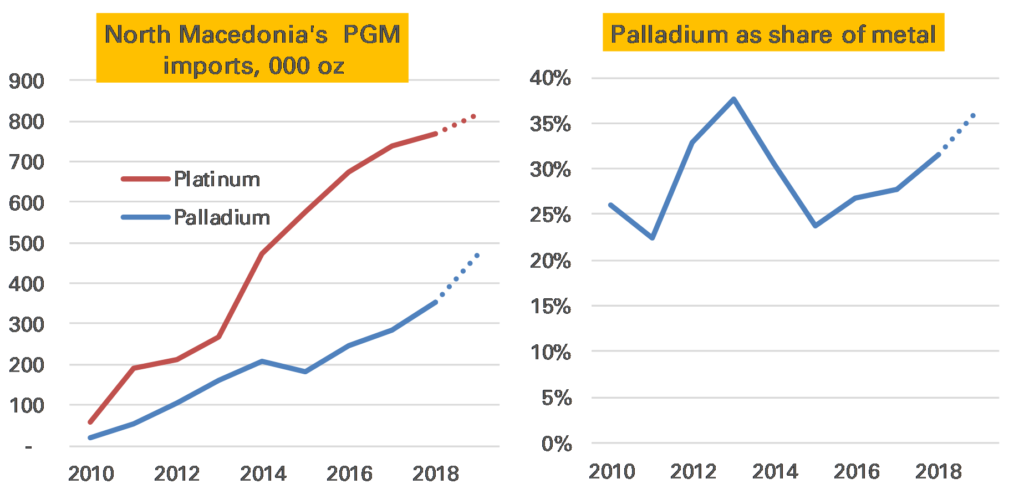

September’s Macedonian trade data is out, important for PGM market participants as it is the best way I can come up with to track whether super-expensive palladium is being substituted out of the diesel catalysts for cheaper platinum 1.

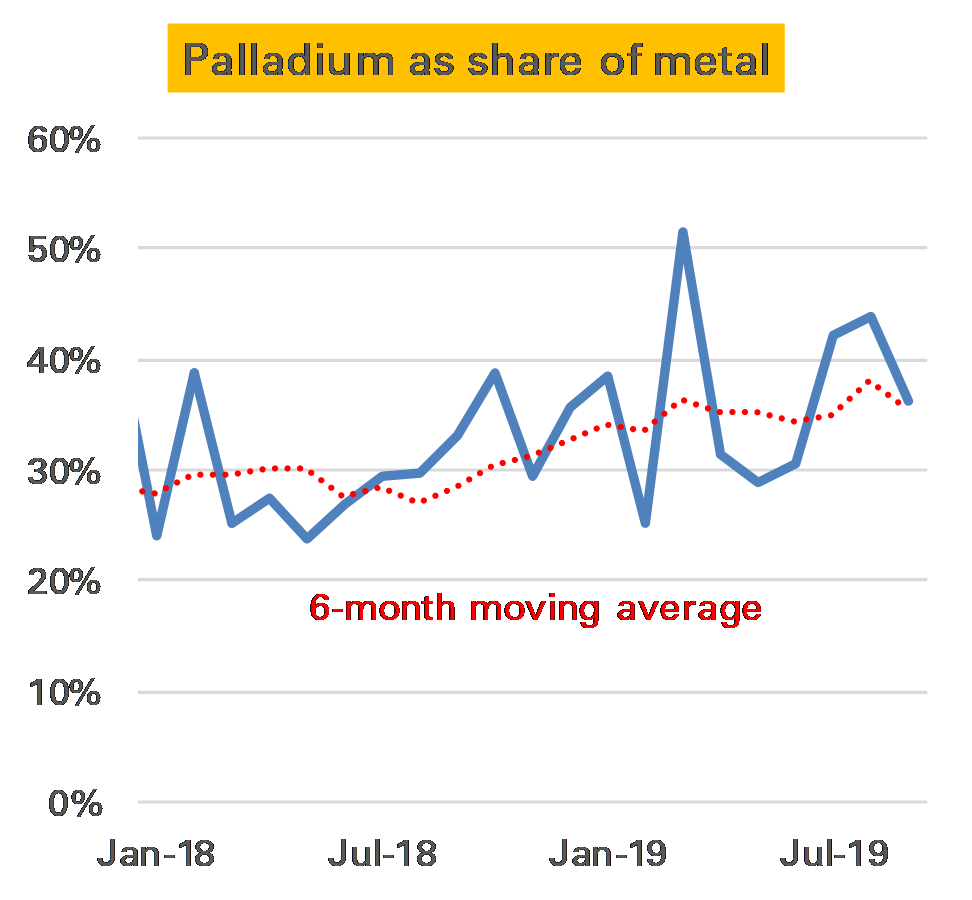

So far there has been no evidence of such substitution, indeed the palladium ratio of the two metals has actually trended higher through most of this year.

September was a little different. Imports of both metals plunged, but because palladium fell more sharply, the implied ratio did move in platinum’s favour, to 36% by weight, compared to 44% in August’s data.

Source: UN comtrade, Matthew Turner, November 2019

But it’s way too soon to read anything into this. 36% is actually the six-month average, and higher than seen in many months this year.

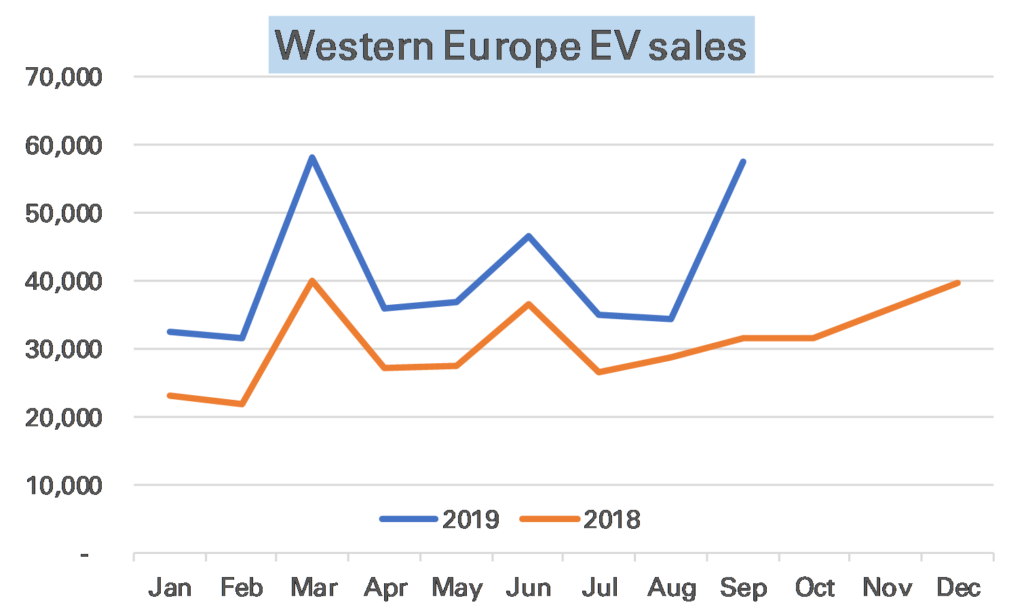

The sharp fall in imports of both metals is quite interesting. It seems unlikely there is going to be sharp fall in output so one suggestion that comes to mind is metal was being stockpiled ahead of potentially disruptive “no-deal” Brexit (the metal comes from the UK), though that is guesswork.

What is clear is the imported price of palladium is rising fast. In September it was $1,570/oz, the highest on record. That corresponds to the market price in the first part of the month – October’s was much higher.